Understand UPS – Unified Pension scheme in 10 points.

Cabinet, led by PM Narendra modi Ji, has approved the Unified Pension Scheme (UPS), effective from April 1, 2025.

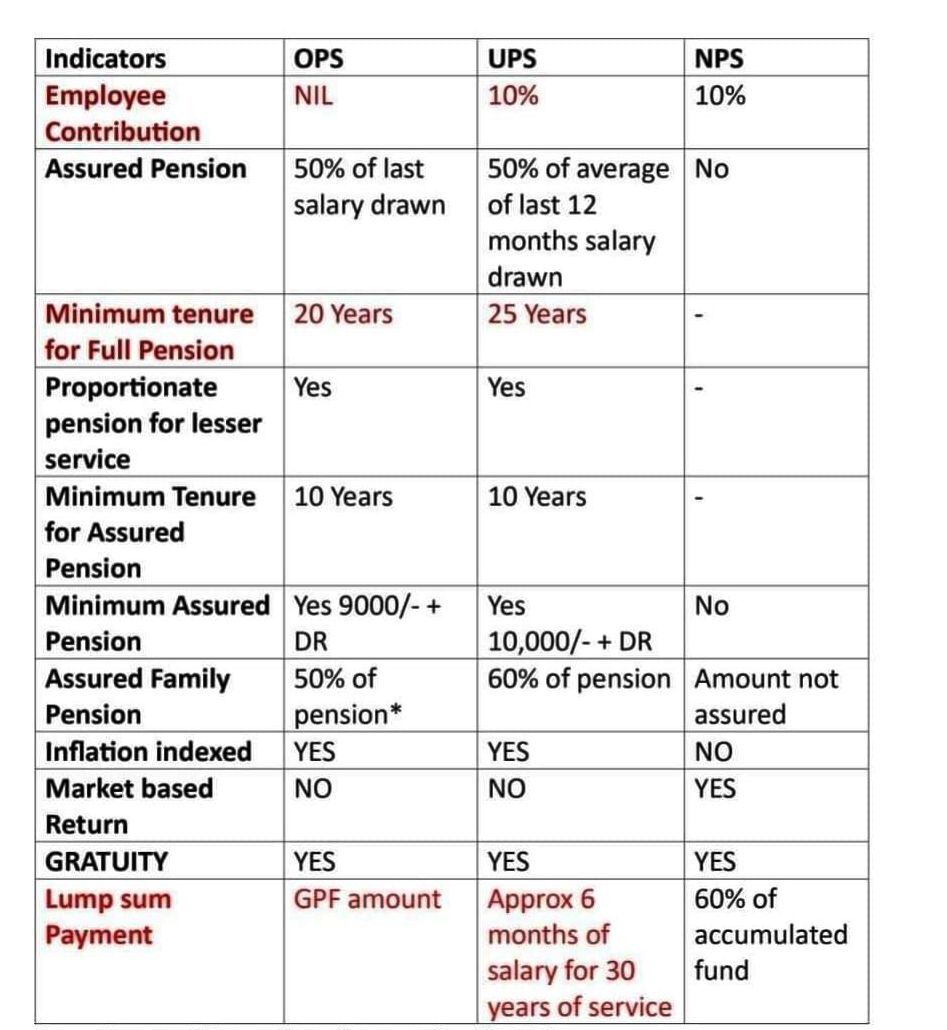

- Assured Pension: Retirees will now receive 50% of their average basic pay over the last 12 months before retirement as a pension for a minimum qualifying service of 25 years. Proportionate for lesser service period upto a minimum of 10 years of service.

- The Government is increasing its contribution from 14% to 18.5%. Employee contribution will not increase.

- Assured Family Pension: In case of a pensioner’s unfortunate demise, their family will receive 60% of the pension the employee was receiving.

- Assured Minimum Pension: ₹10,000 per month as pension, on superannuation after minimum 10 years of service.

- Inflation Protection: Pensions will be indexed to inflation! Dearness Relief will be based on the All India Consumer Price Index for Industrial Workers (AICPI-IW), as in case of serving employees.

- Provisions of UPS will apply to past retirees of NPS (who have already superannuated). Arrears for past period will be paid with interest at PPF rates.

- Lump-Sum Payment at superannuation in addition to gratuity. 1/10 th of monthly emoluments ( pay +DA) as on the date of superannuation for every completed six months of the service. This Payment will not reduce the quantum of assured pension.

- UPS will be available as an option to the employees. Existing NPS / VRS with NPS as well as future employees will have an option of joining UPS. Choice, once exercised, will be final.

- UPS is being implemented by the Central Government. Benefiting ~23 lakh Central Government employees.

- The same architecture has been designed for adoption by State Governments. If also adopted by State Governments, can benefit over 90 lakh Government employees who are presently on NPS.